Yields Break, Mag 7 Compared to Equal Weight, Dow Reaches Record Highs

Mulvihill's Daily Charts and Market Musings (12.14.2023)

More charts, less words, primarily Canadian focus.

Let's begin!

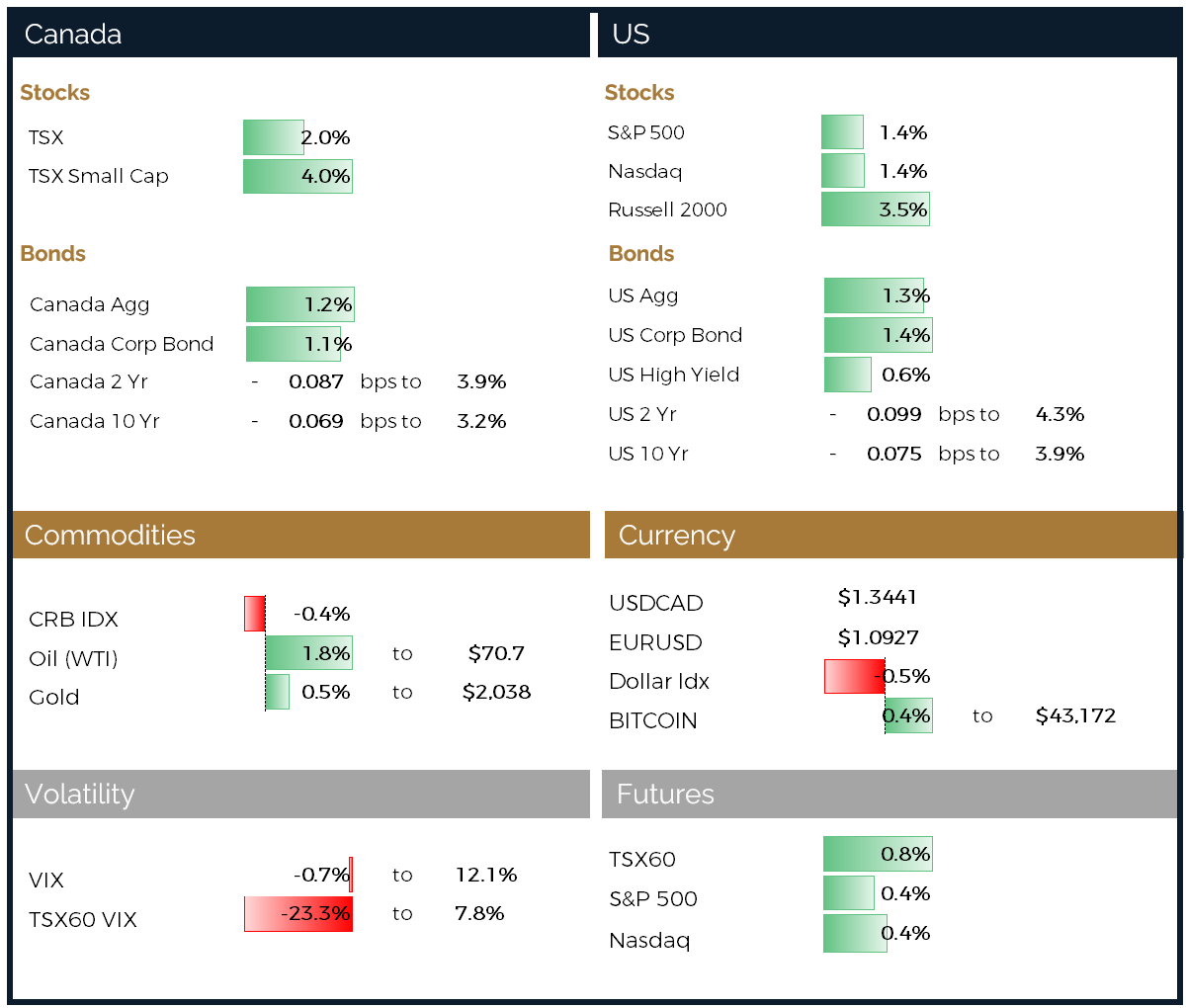

Stocks and bonds experienced a surge, while the dollar saw a decline following indications from the Federal Reserve that interest-rate cuts are anticipated in the coming year. This unleashed a wave of optimism across markets, with the belief that inflation pressures are subsiding. Nasdaq 100 futures rose, positioning the underlying tech-heavy index for a potential record-setting close. S&P 500 contracts also inched up after the benchmark finished just 2% below its record high on Wednesday.

A few notable observations from yesterday:

Yields broke the trend we highlighted on Tuesday, sending stocks and everything else higher. Ten-year yields have fallen below the 4% level this morning, pushing futures higher.

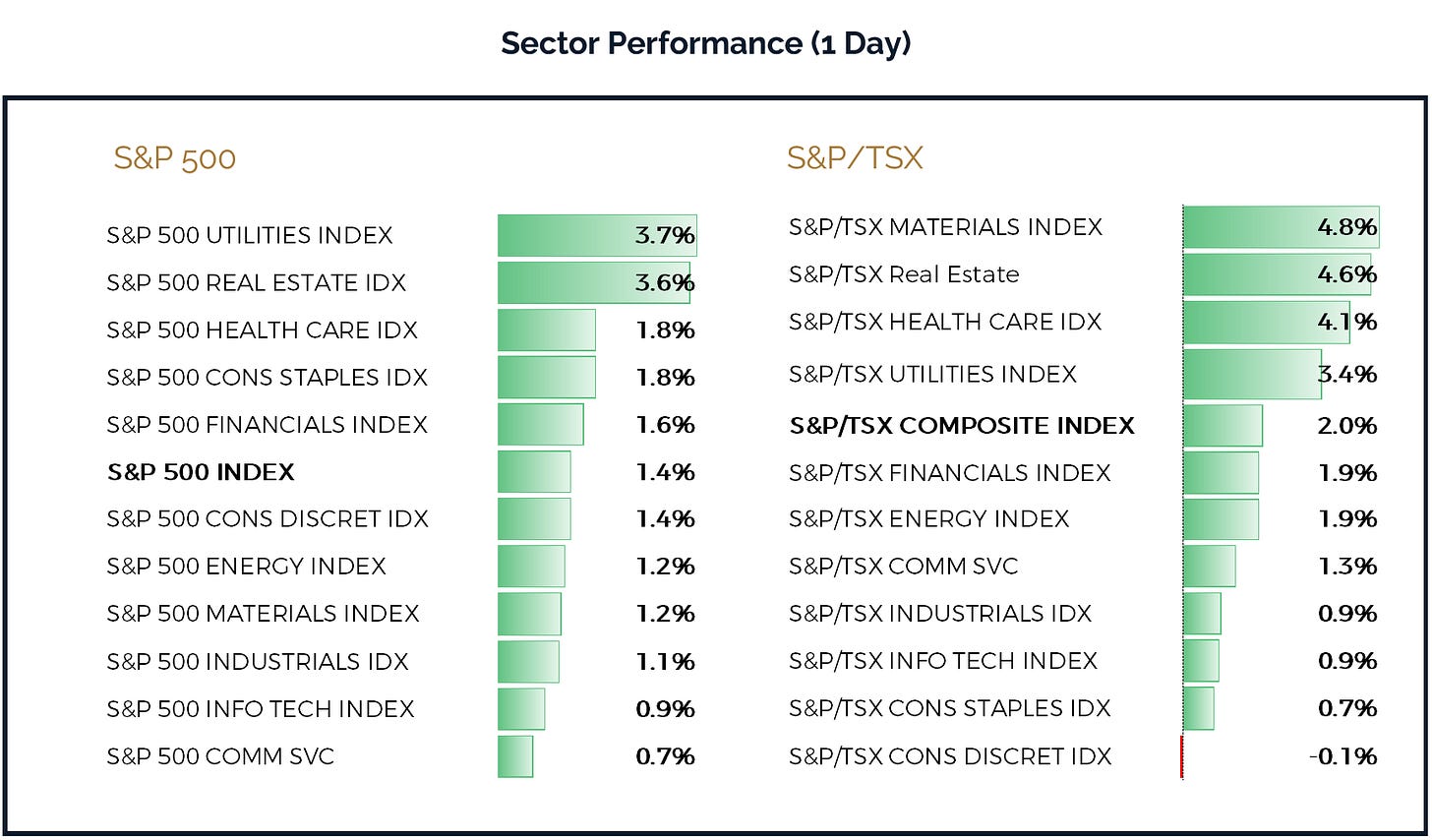

Equal weight (+2.1%) outperformed as the market continues to broaden. Small-cap and value led the way among US factor returns.

Interest-sensitive sectors of the market that were most adversely affected by higher yields, such as Utilities and REITs, led the upside.

Every sector in the US and Canada was in the green, with the exception of the TSX Consumer Discretionary, which was dragged down by DOL.

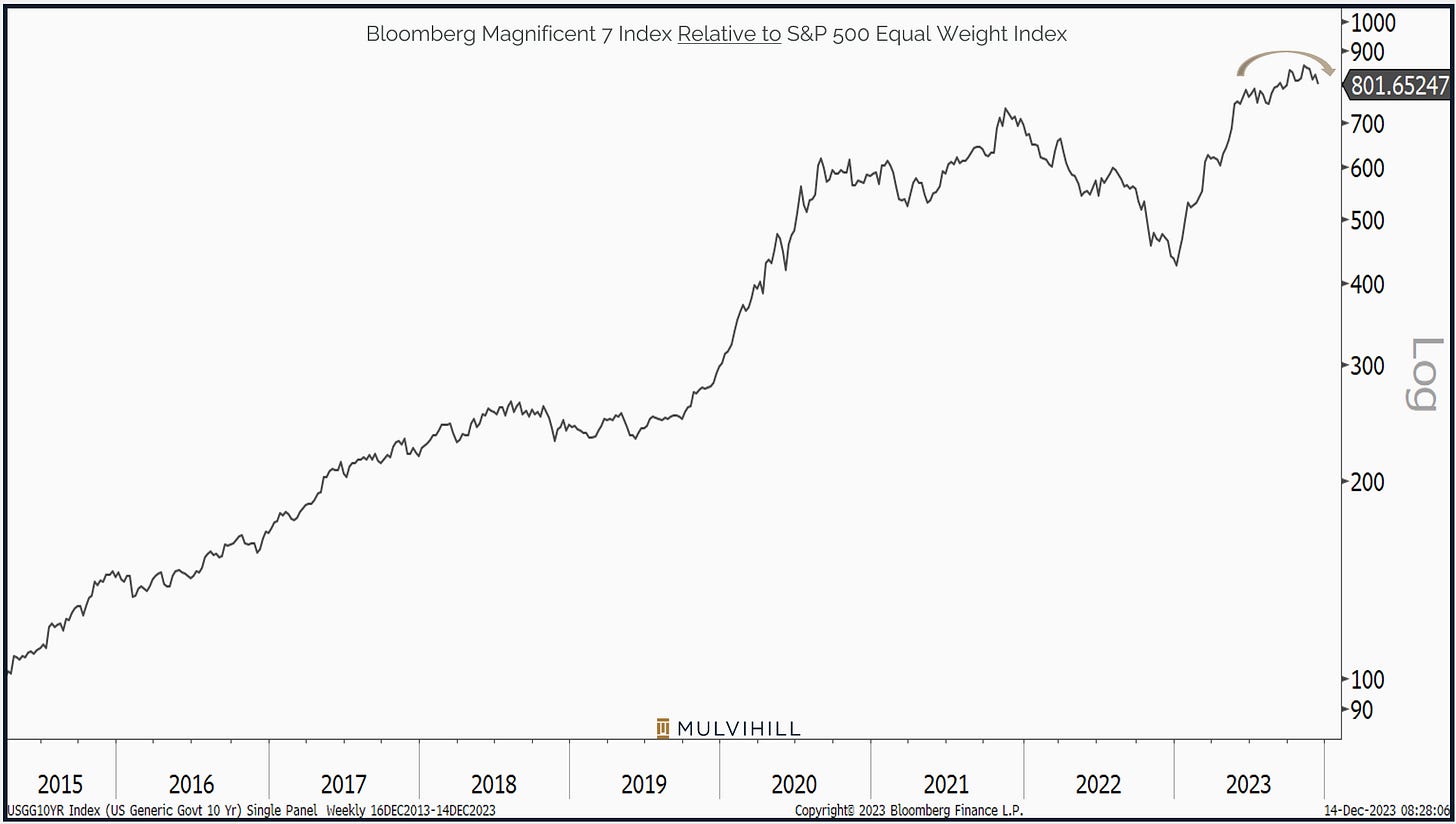

Technology was the worst-performing sector in the S&P 500, albeit still in positive territory. This may symbolize the nature of the catch-up trade, suggesting that while high-valued tech stocks like the Mag 7 can still move higher, their relative performance will decrease.

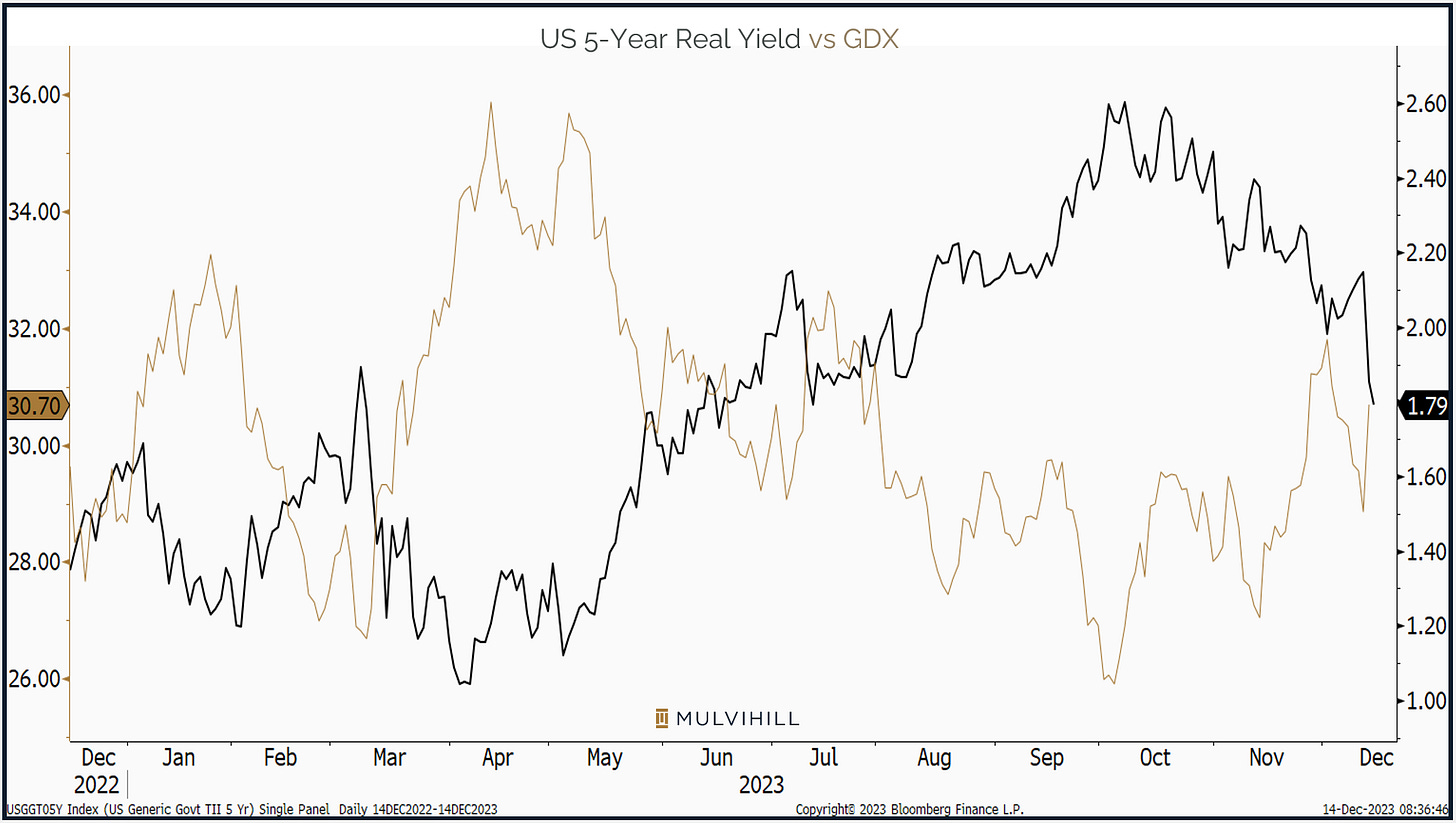

Yesterday made it clear that gold stocks need lower yields to perform well. GDX soared over 6%. Admittedly, we dedicate an excessive amount of time to this subject, acknowledging the relative insignificance of gold miners in the broader investing landscape. But, being Canadian, what can I say.

The VIX moved higher, which is not what one would typically expect when stocks are moving higher

The market is clearly signaling its anticipation of rate cuts next year and revealing which pockets of the market will thrive. The question arises: why would the Fed consider cutting rates with inflation above 2%, a tight labor market, and stocks on the verge of reaching all-time highs? Setting up an interesting market dynamic as we move into 2024.

US 10-Year Treasury Yields Dip Below 4% Mark This Morning

Bull market? Time to buy utilities and REITs... said no one ever

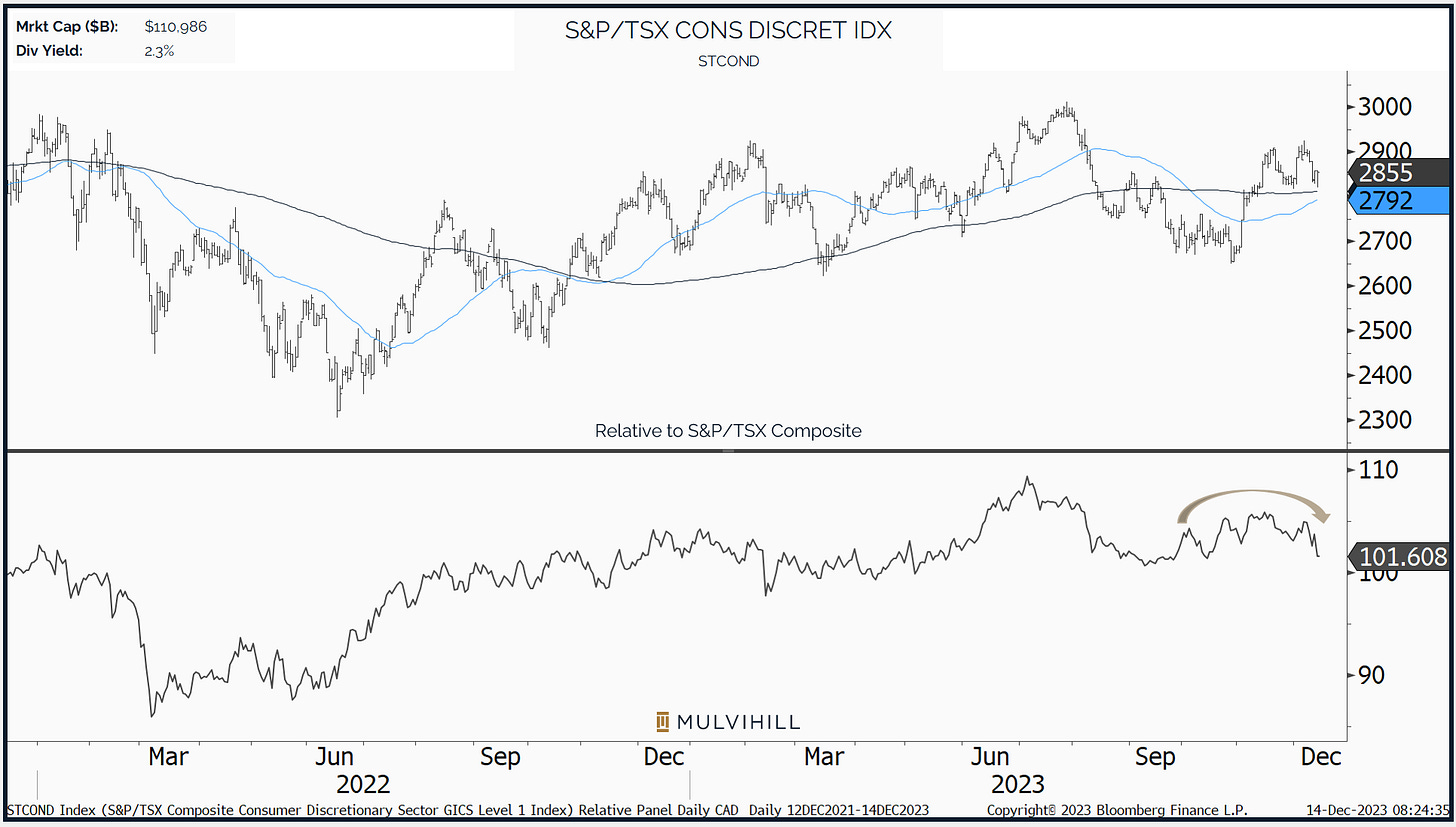

Not a major concern at the moment, but there is notable relative underperformance from the TSX Consumer Discretionary sector

This Could Be the Pivotal Chart to Monitor in 2024

Lower real yields are propelling gold miners

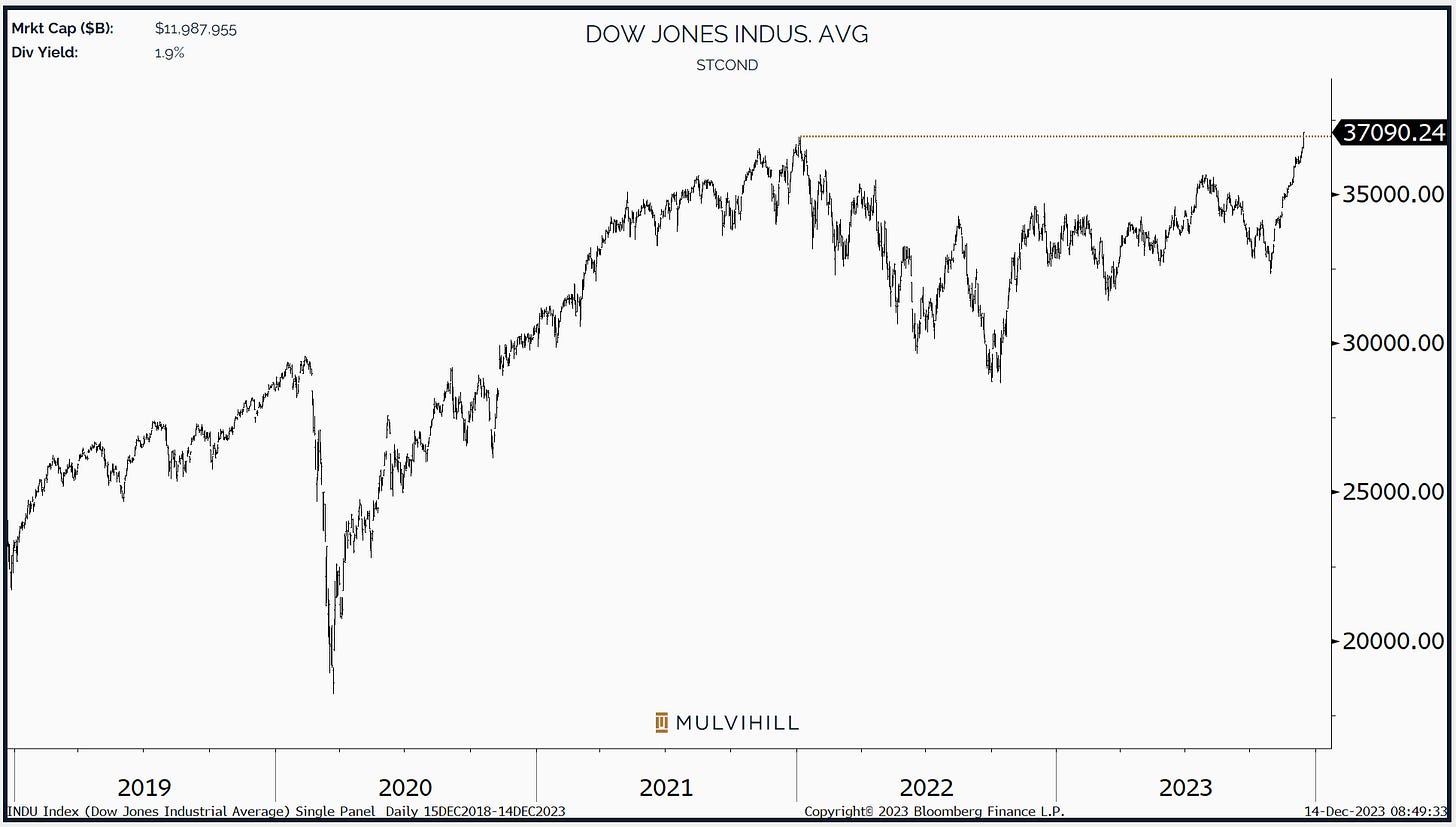

Dow Jones Achieves All-Time High

Nasdaq 100 Next?

That's all for today.