Yields and CPI Data, China Faces Deflationary Pressures, Semiconductor Maintains Leadership, Stock Charts of Interest

Mulvihill's Daily Charts and Market Musings (12.12.2023)

More charts, less words, primarily Canadian focus.

Let's begin!

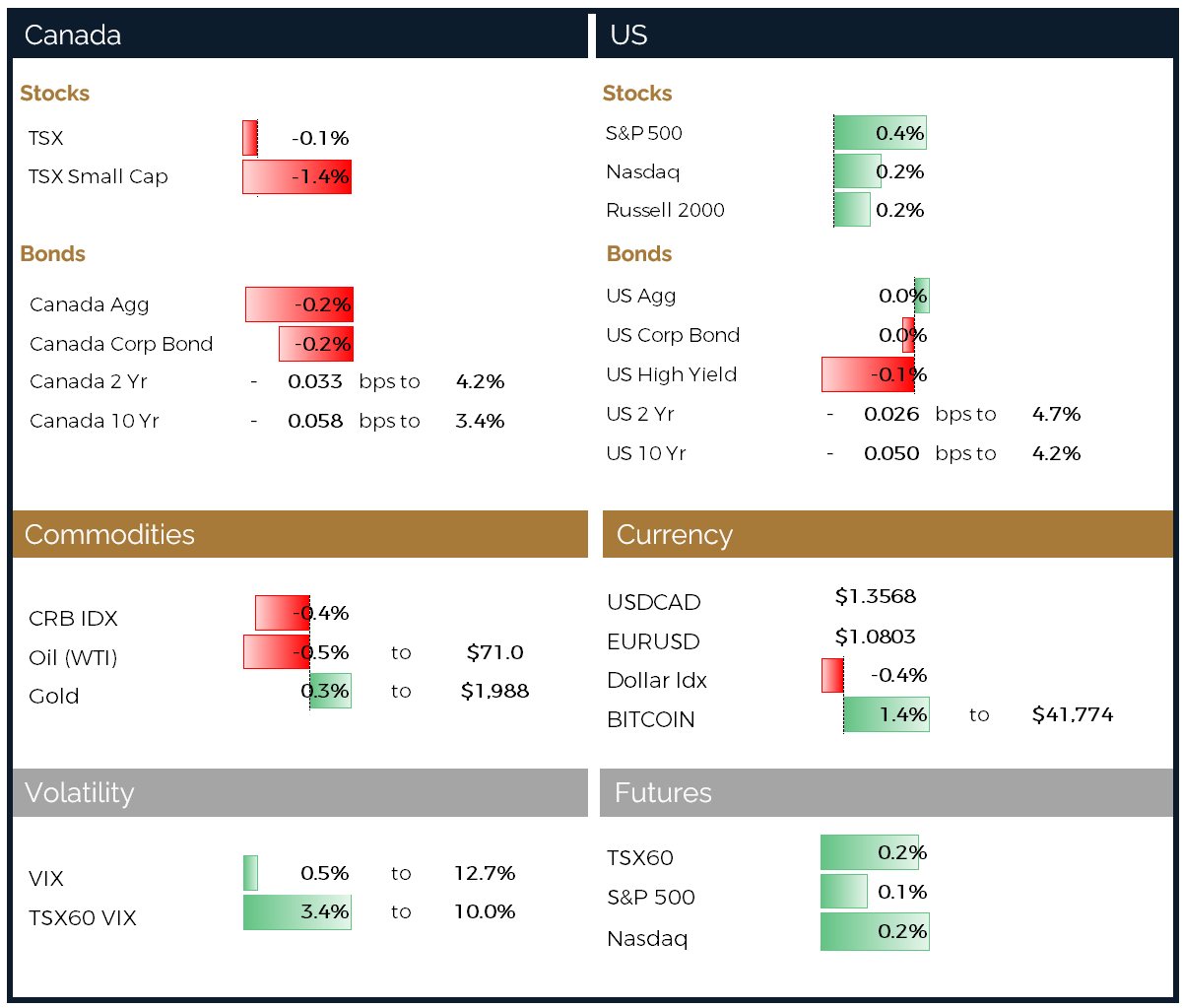

Stock futures remained calm before a pivotal inflation report, with Treasury yields and the dollar seeing declines. Investors are closely monitoring Tuesday's Consumer Price Index (CPI) for indications of disinflation. The Federal Reserve is anticipated to maintain rates in its final decision of 2023, with attention on Chair Powell's guidance amidst a dovish market sentiment. The projected November CPI is at 3.1%, marking the lowest level since the dollar's low in June.

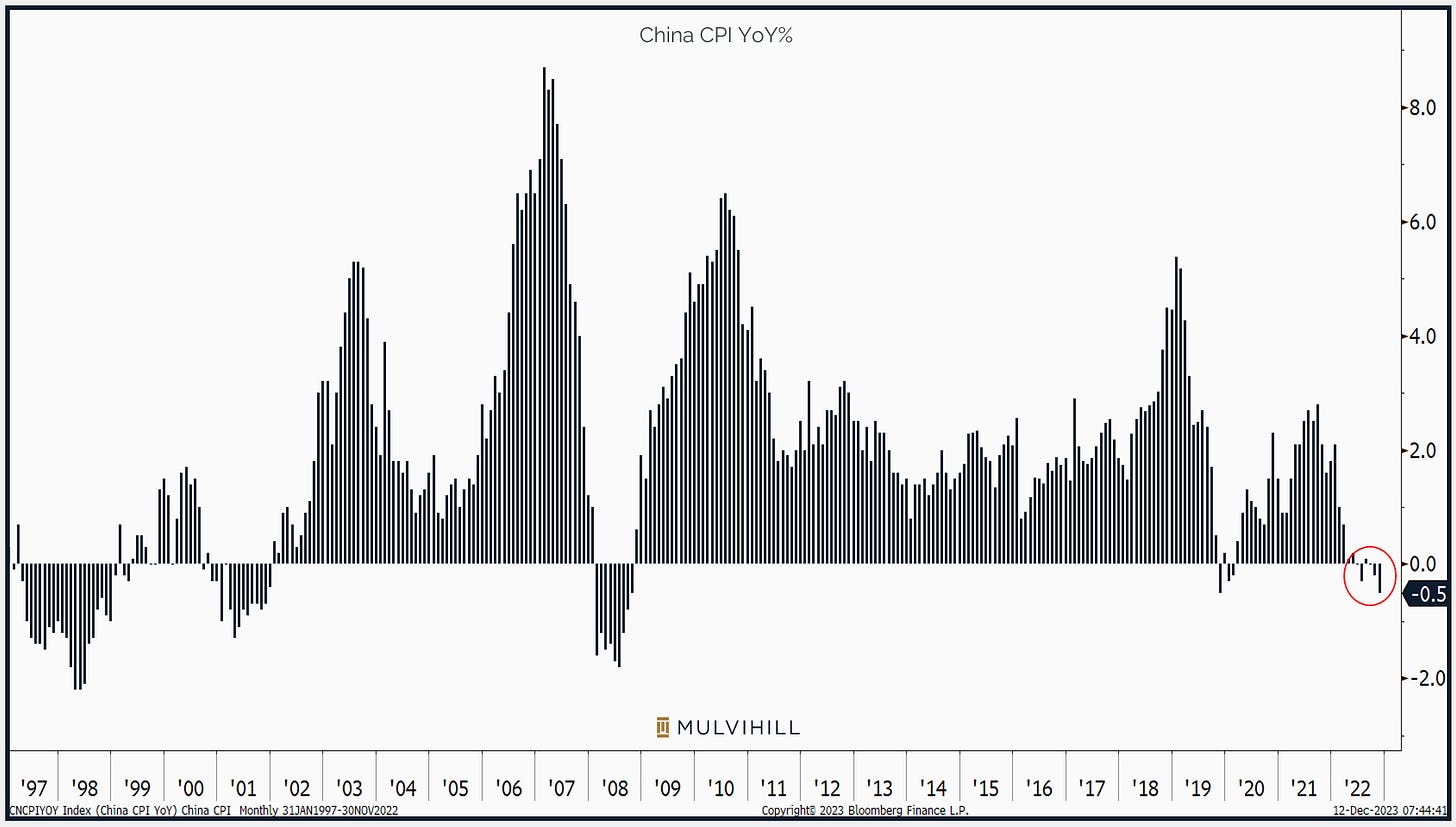

The 10-Year yield rests on a critical upward trend line, coinciding with the upcoming US Inflation report. Given recent market trends, a lower-than-expected CPI could potentially lead to a break in yields, propelling stocks higher. Notably, China's YoY CPI remains in negative territory.

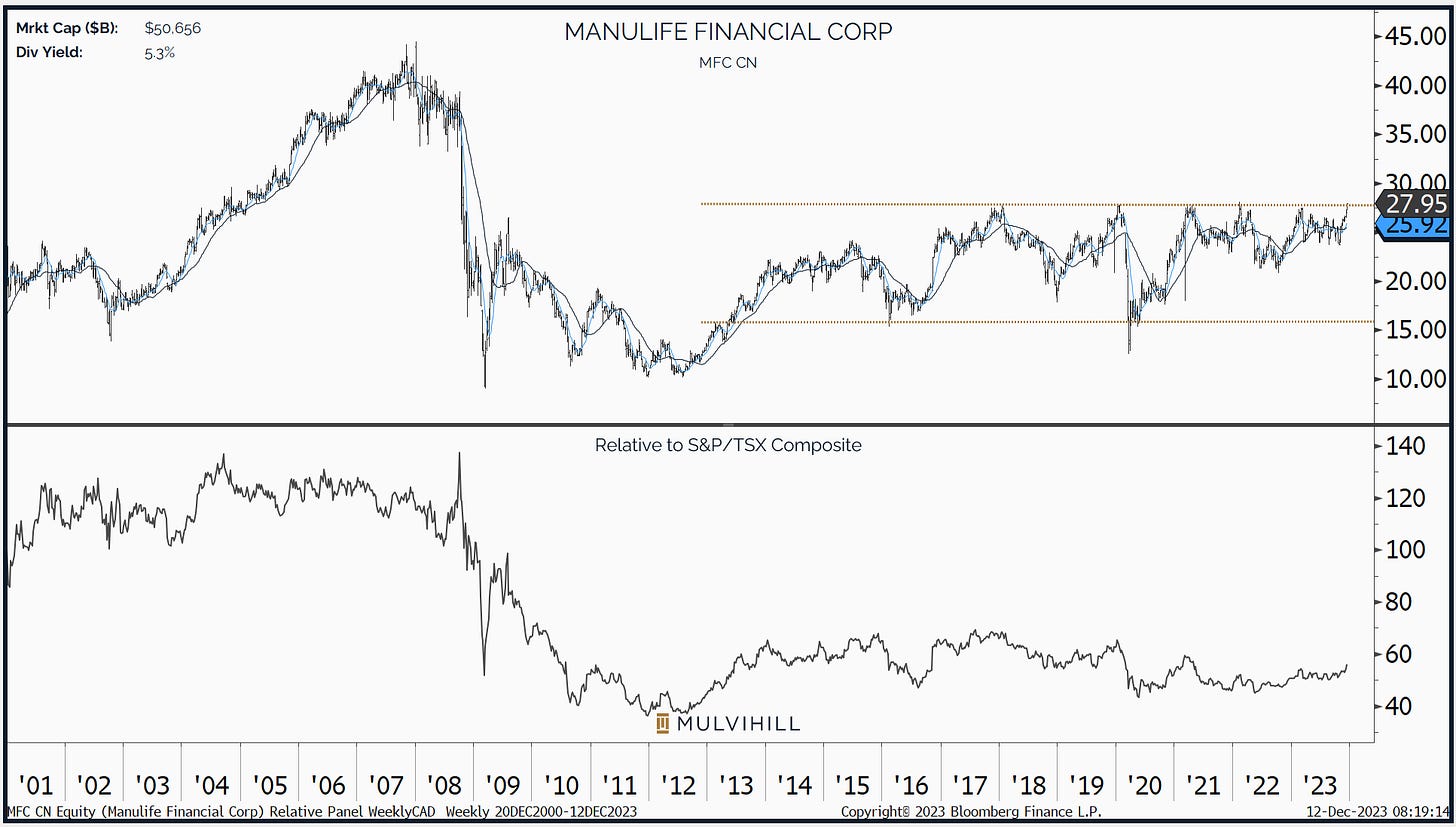

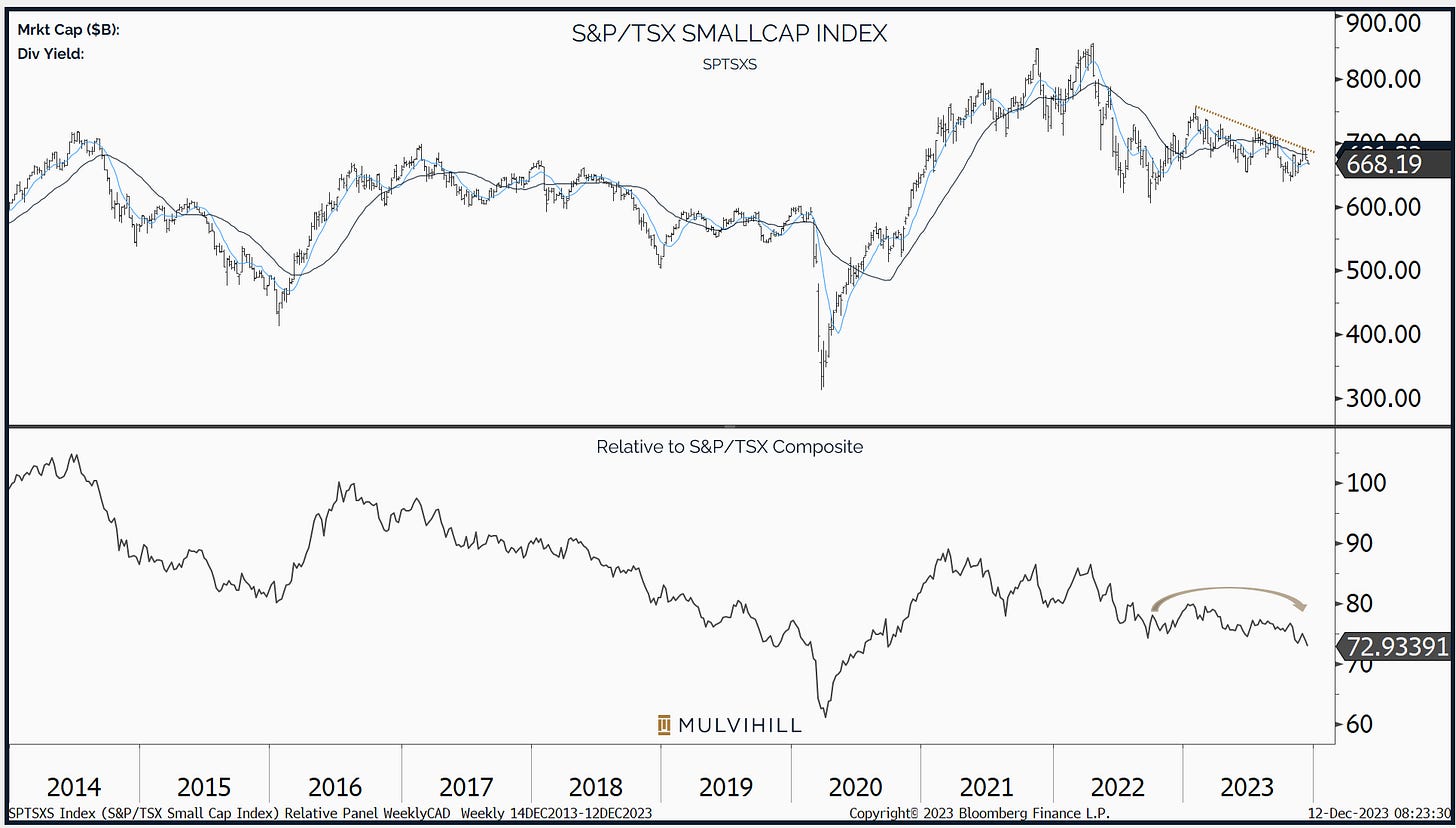

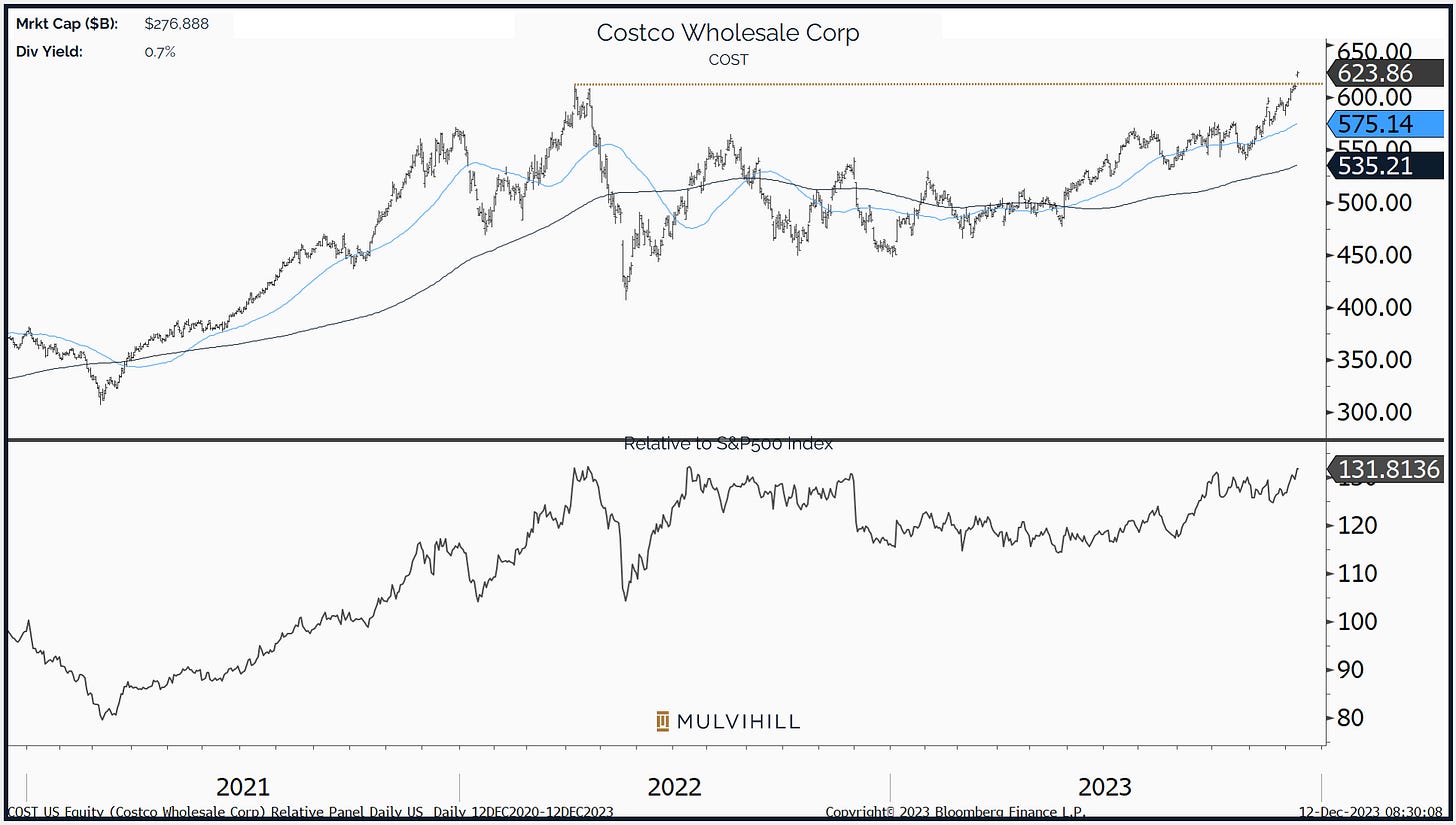

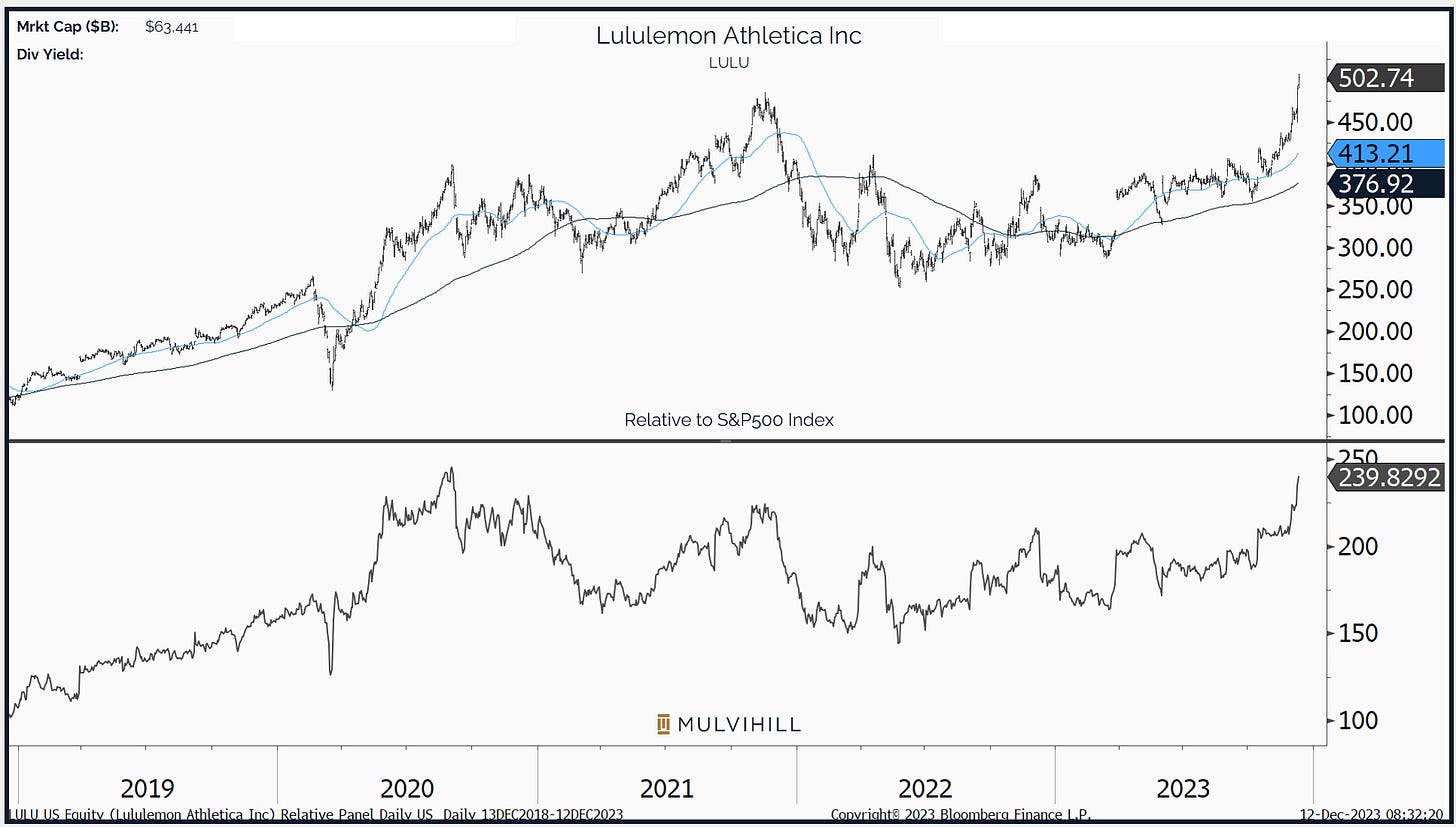

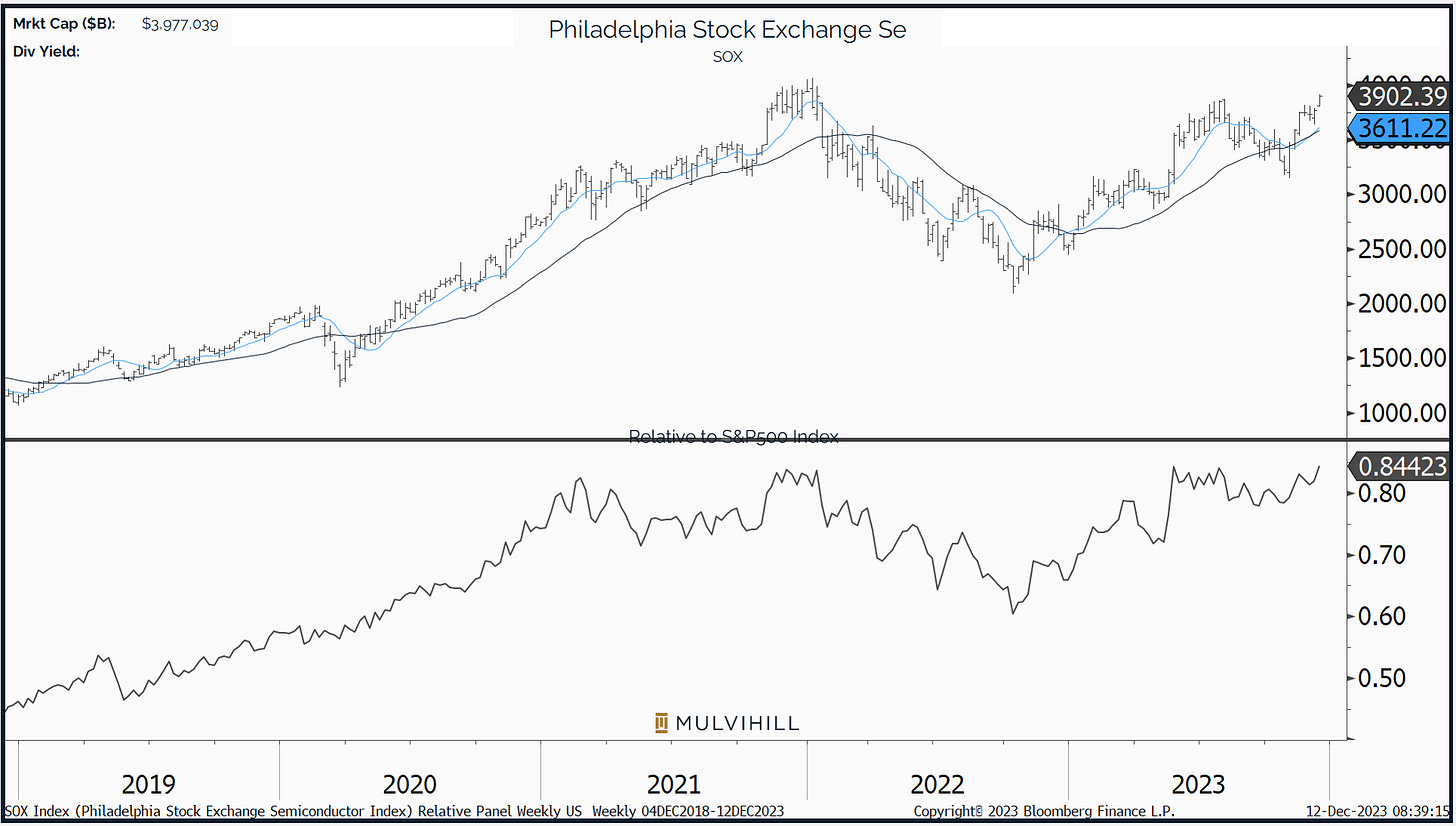

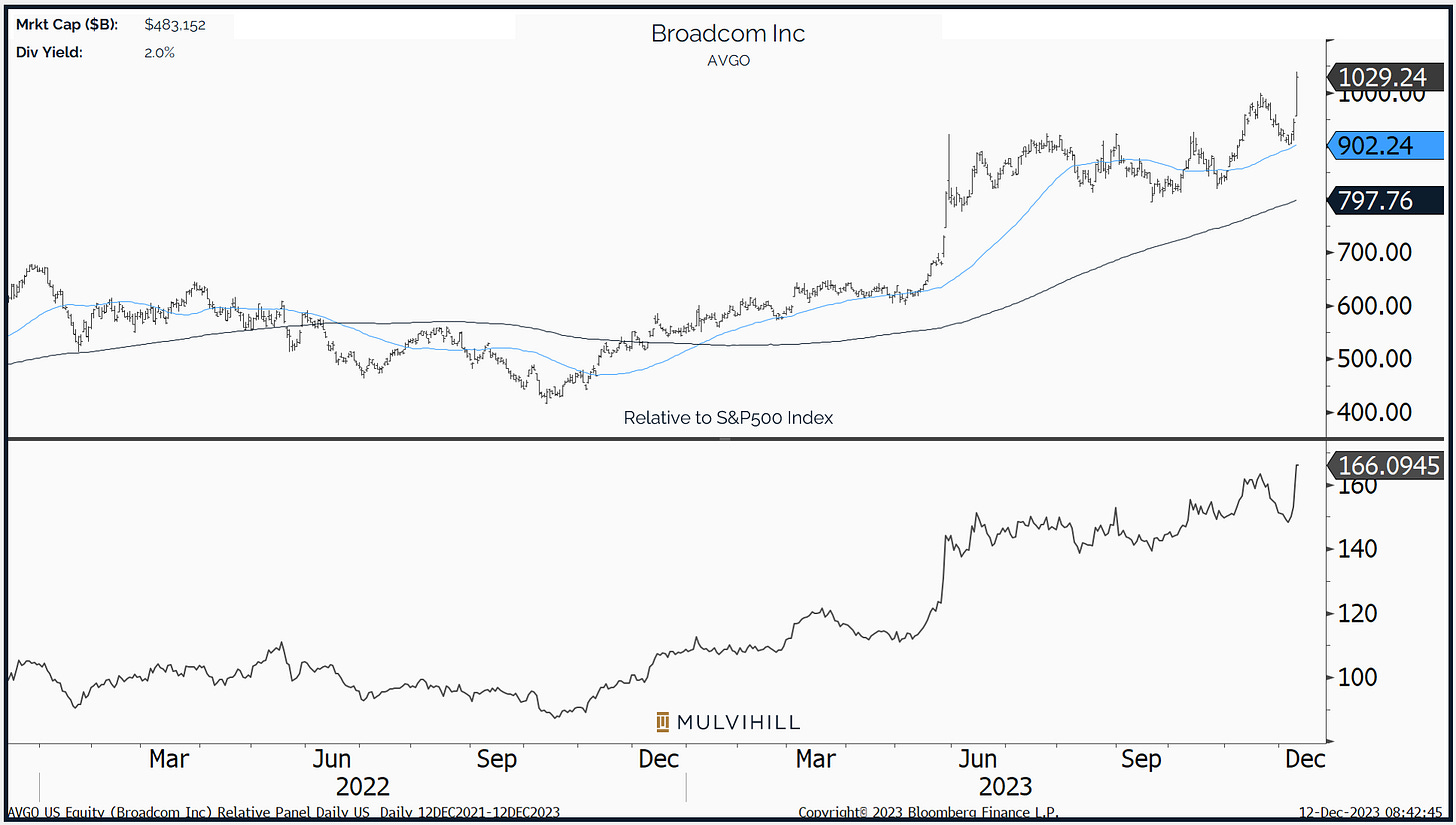

On the stock front, financials remain a focal point in our analysis. Manulife appears poised for a breakout after a decade of repairing chart damage from the Global Financial Crisis. In Canada, market leadership persists at the top, with minimal participation from the TSX Small Cap Index. In the US, Costco reached all-time highs, and the semiconductor sector maintains strength, propelled by a surge in AVGO yesterday and AMD on Friday.

Keep a Close Eye on 10-Year Yield Post CPI Data Release

China's CPI Remains in Negative Territory

Manulife Poised to Breakout

TSX Small Cap Index Lacks Leadership

Costco Reaches All-Time Highs

Highlighted a few weeks ago, still favoring the momentum in LULU

Semiconductors continue to show strong performance

AVGO bolstering the group's performance yesterday

That's all for today.