Stock-to-Bond Ratio, November Gains, Chicago PMI Surges

Mulvihill's Daily Charts and Market Musings (12.01.2023)

More charts, less words, primarily Canadian focus.

Let's begin!

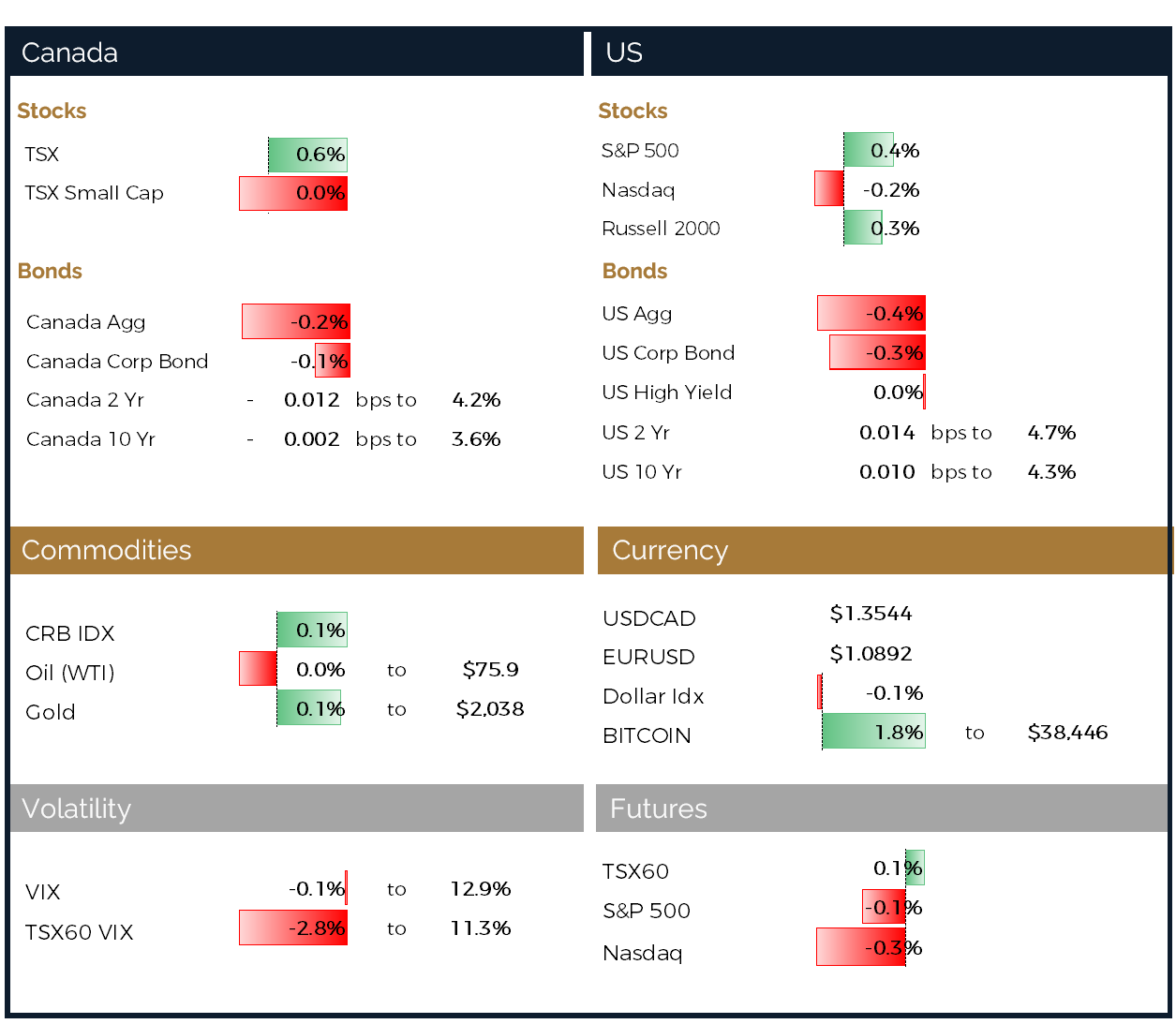

Equity futures saw a slight decline in anticipation of statements from Federal Reserve Chair Jerome Powell, which could shed light on the direction of interest rates. Meanwhile, oil prices remained in the red after OPEC+ pledged additional output cuts, although the details of these cuts were not clearly outlined. US Treasury yields fell by around 60 basis points over the month.

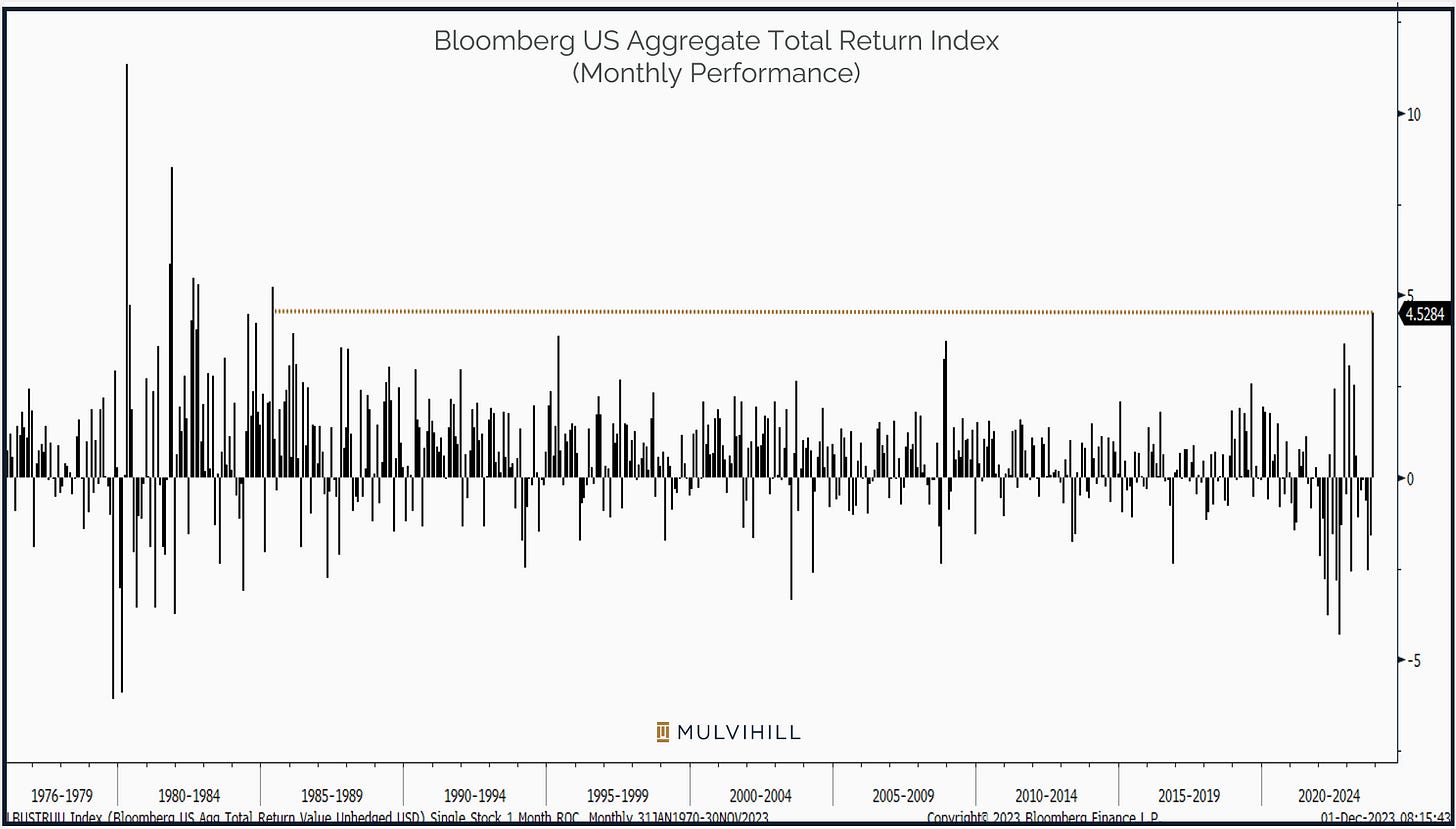

As November concludes, a widespread surge was observed in both equities and fixed income markets. Despite headlines emphasizing bonds achieving their most significant monthly return since 1985, with the Bloomberg US Aggregate Bond Index rising by 4.5%, there is notable oversight as stocks outperformed, doubling that return. The allure of potentially peaking interest rates and higher yields is appealing for fixed income, but it holds even greater potential for certain segments of the equity market that have been adversely affected by elevated rates, such as Financials, Utilities, REITs…

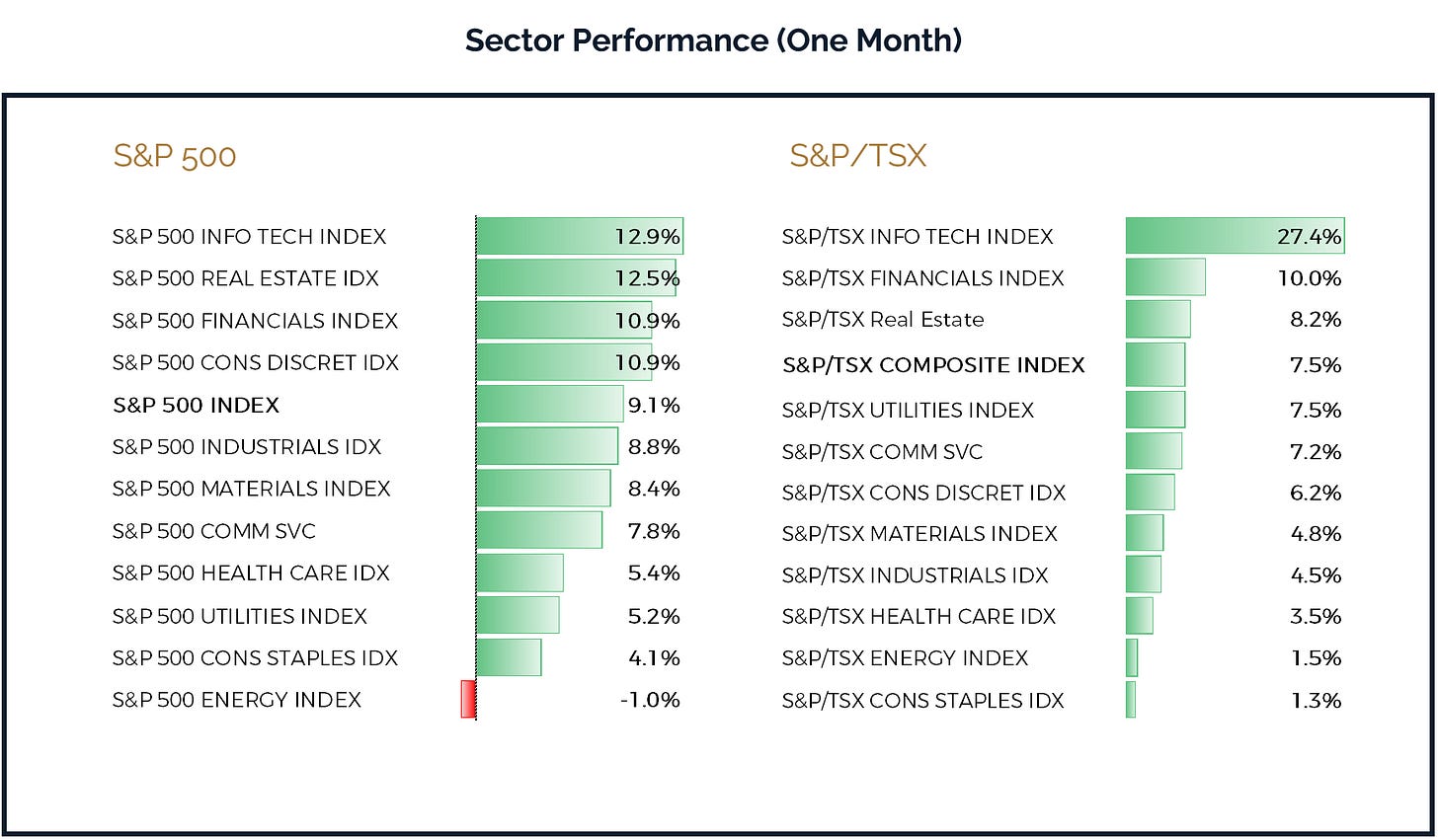

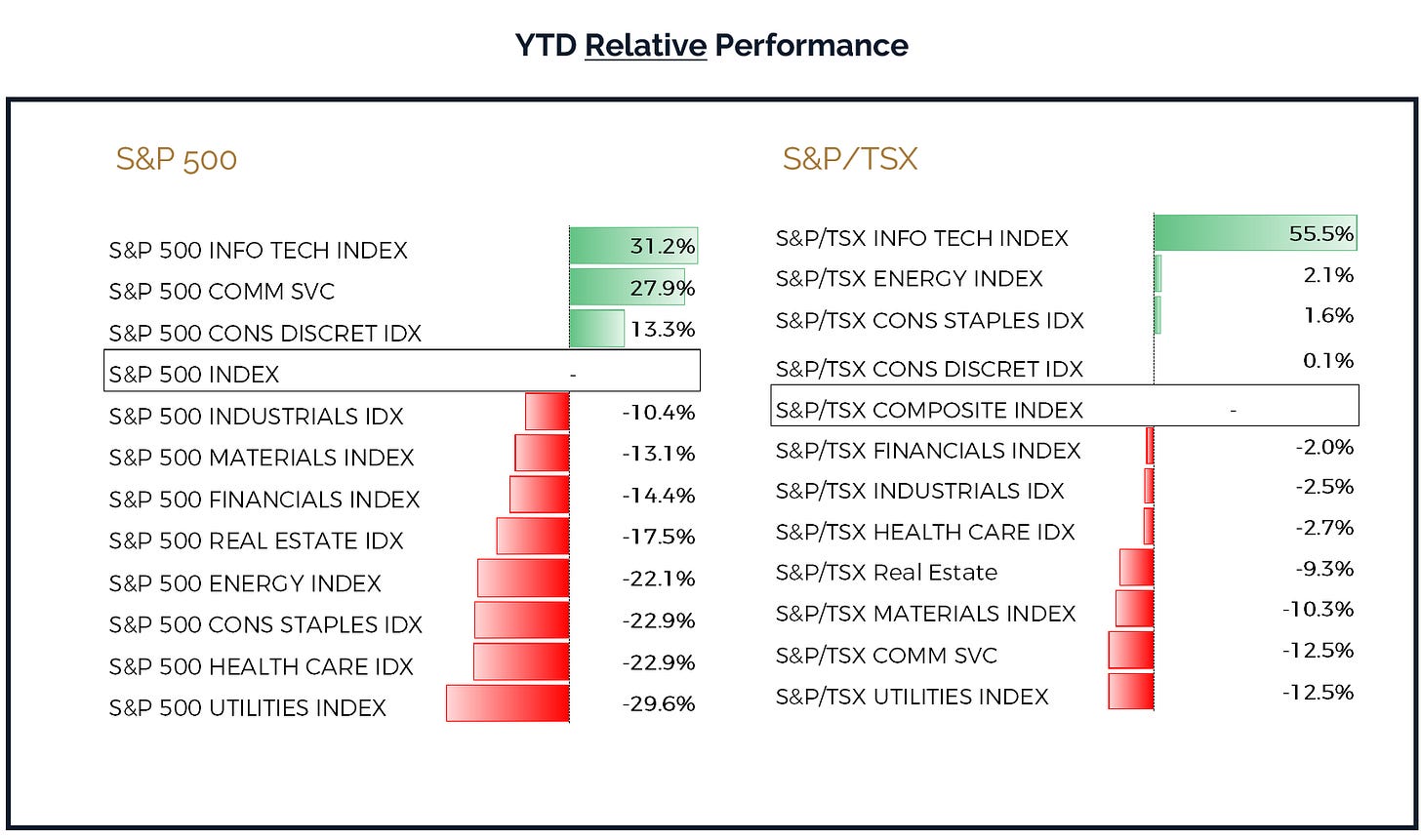

In Canada, all sectors showed positive performance for the month, with only the energy sector in the red for the S&P500. Technology emerged as the top performer in both the U.S. and Canada. Heading into 2024 my view remains that unless the Federal Reserve (FED) opts for rate cuts due to concerns about a hard landing (which would be positive for bonds), stocks will likely present better investment opportunities. As we approach the year-end, it's noteworthy that only three sectors are outperforming the S&P500, and four sectors are outperforming the TSX.

Best month for US Agg since 1985

Sector Performance in November

Returns were strong and robust in the month

Year-to-Date (YTD) Sector Relative Performance

Leadership remains highly concentrated, with only three sectors outperforming in the US and four in Canada (three of them showing marginal outperformance)

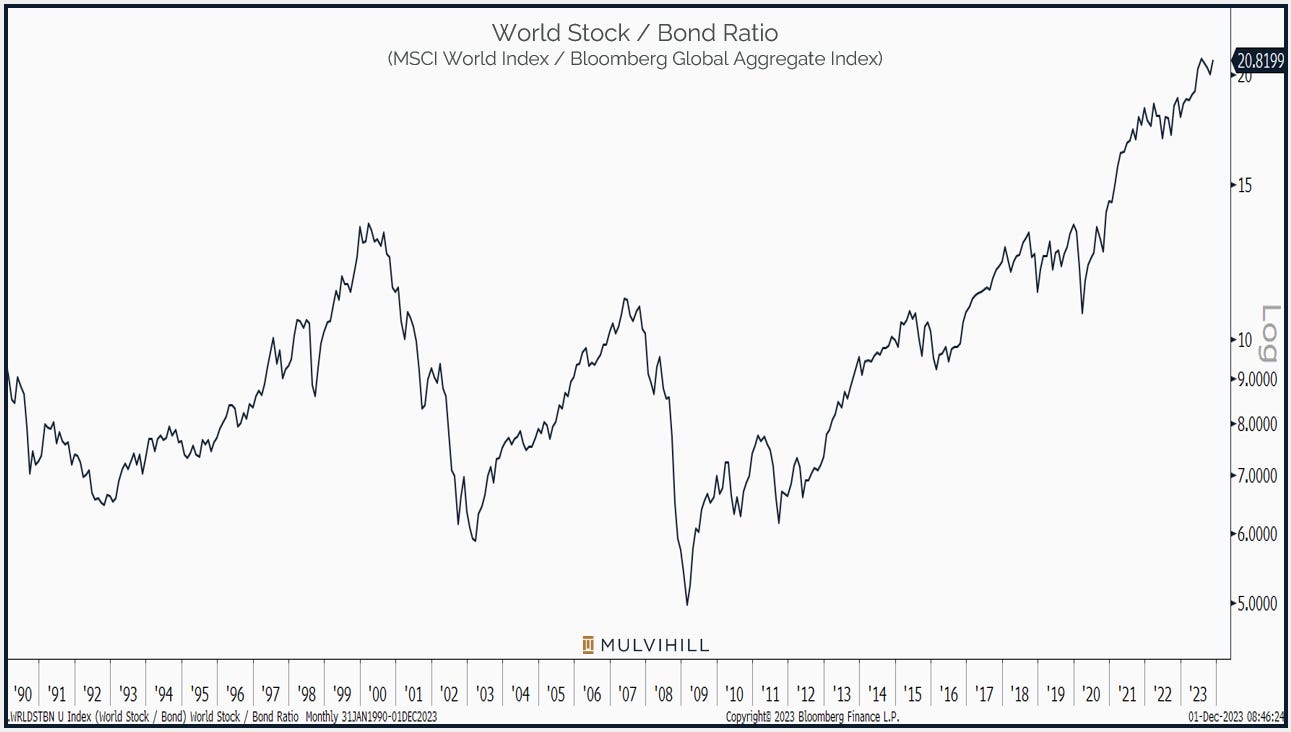

Global Equity-to-Bond Ratio

While bonds are garnering significant attention, it’s hard to call a peak in this trend

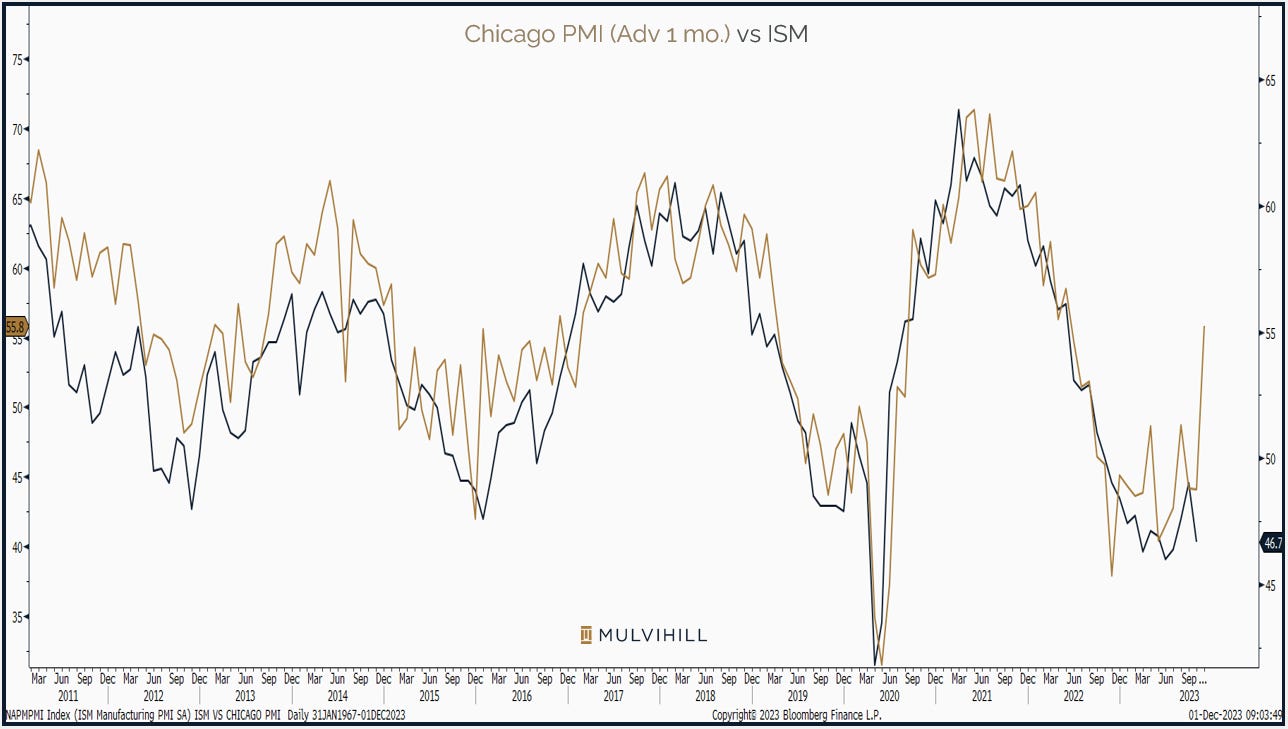

Chicago PMI turns

The Chicago PMI, released yesterday, exceeded expectations at 55.8, a substantial improvement from the previous month's 44, historically serving as a reliable precursor to the direction of the Institute for Supply Management (ISM) data, which is expected to be released at 10 am this morning

That's all for today.